Op-ed | Herding rockets: Improved Space Traffic Management will accelerate industry growth (Image Credit: Space News)

A market ecosystem that incentivizes the rapid development and fielding of advanced Space Traffic Management (STM) technologies will be a key enabler to the sustainable growth of the space economy. As defined by the International Academy of Astronautics , STM protects future sector growth by encouraging the development and application of technology to preserve access to space and assets already in orbit.

The call for a revamped STM policy structure has been made and includes recommendations for drawing lines around launch, licensing, and funding. Ensuring equal access to space by creating standards for collecting data for Space Situational Awareness (SSA) and space launch will, in turn, increase the likelihood of successful Space Debris Management (SDM), as the more effectively managed the launch market, the lower the volume of space debris to deconflict and mitigate collision risk.

In this context, this piece focuses on why STM technologies must be fielded today with support from both government and industry. Government can promote the growth of STM capabilities by ensuring its own assets — and those it uses for space-based services — can accurately detect other assets, avoid collisions, and de-orbit. Government can also invest in the research and development of these technologies while providing support for publicly accessible SSA data.

Indeed, the $87.8 million budget the White House is seeking for the U.S. Office of Space Commerce budget for 2023 — an 800% increase over the previous budget — is just the kind of instrument that industry needs to enable the rapid development and fielding of emerging technologies.

Robust funding for the U.S. Federal Aviation Administration’s Office of Commercial Space Transportation ($42.7 million), as well as its Launch Licensing ($6.2 million) and Commercial Space Integration ($10 million) components, should drive the selection of capabilities that will shape how space transportation is effectively managed.

Commercial entities — and the investors that back them — should continue refining STM technologies to improve their application and integration and develop more use cases. Such technologies enable space-based assets to detect other space assets or space debris, accurately identify one from another, develop protocols for how to respond based on the identification of the space asset or space junk item, and execute those protocols. As governments worldwide identify which agency will have the authority to take action — or instruct a commercial space asset to take action — commercial entities should rapidly refine their STM technologies so the eventual government authorities are prepared for execution on day one.

An increasingly congested environment

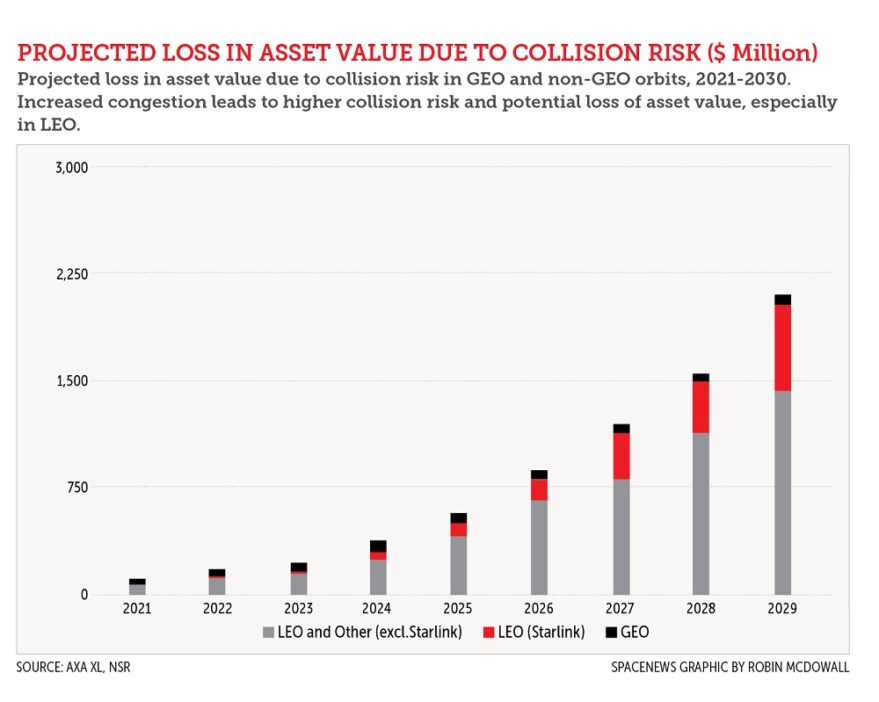

Space 4.0 is bringing an unprecedented new volume of spacecraft into orbit, with a notable expansion of systems operating in low Earth orbit (LEO). This exponential growth has been accompanied by operational hazards in an increasingly congested environment, as illustrated by near-misses between debris, satellites, and other spacecraft, including crewed stations. Based on information from space insurance firm AXA XL, we estimate that the chance of a collision in LEO will grow sevenfold by 2030.

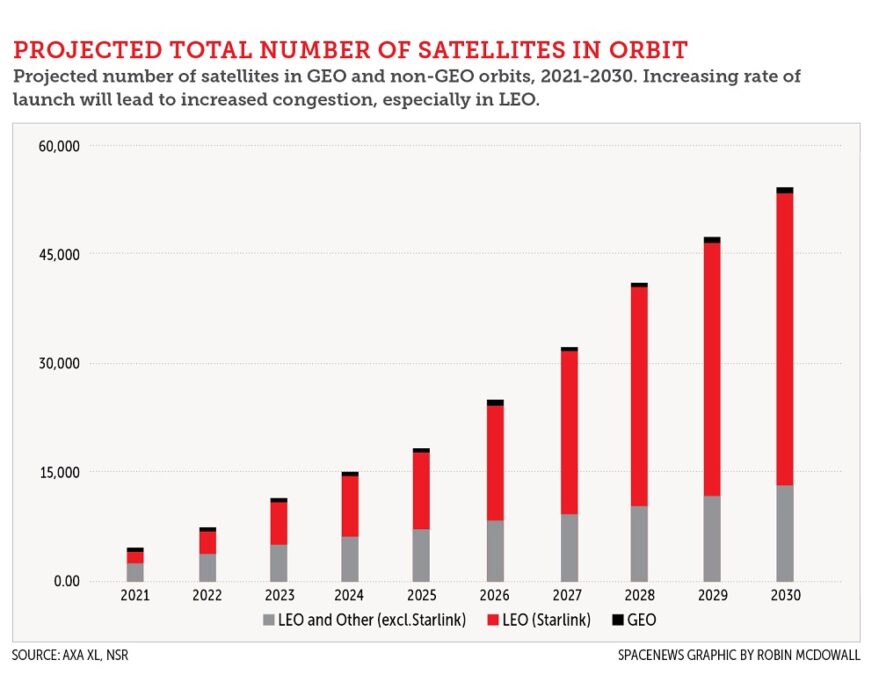

The space sector is also enjoying significant growth across the value chain, as reflected by the rapid expansion in the number of spacecraft in operation. There were approximately 4,400 satellites in various orbital bins — including LEO, medium Earth orbit (MEO), and geosynchronous orbit (GEO) — in 2021, based on figures from Northern Sky Research and AXA XL, with projections of thousands more being added annually during through 2030. Accompanying the growth in spacecraft is an increase in debris, much of it situated in LEO. NASA recently described LEO as an “orbital graveyard” due to the sheer volume of debris in orbit, moving at speeds of up to 29,000 kilometers per hour. More than 30,000 objects currently in orbit are tracked, and of these, 23,000 are large enough (at least 10 centimeters in diameter) to cause significant damage in a collision.

The risk of collisions grows rapidly as the number of objects in orbit increases. While tracking has helped avoid collisions with active spacecraft, near-misses have become routine. Close passes by SpaceX Starlink satellites and the Chinese space station in July and October prompted the Chinese government to call on all actors to be responsible in a way that is consistent with the Outer Space Treaty.

The anticipated proliferation of both spacecraft and orbital debris will likely drive further hazards and illustrates the need for a comprehensive approach to manage space traffic and ensure the sustainable growth of commercial space. Moreover, protecting the growth of the space economy and preserving access to space for all entrants — commercial and government — can only occur if technologies for collision risk mitigation and maneuverability are further developed.

Calculating collision risk is increasingly tricky

Increased congestion is made riskier because existing mechanisms for measuring collision probability across orbital bins are insufficient. A study published in the February edition of the Journal of Space Safety Engineering noted: “satellite operators commonly use NASA’s Debris Assessment Software (DAS) tool… [however] analysis results show that not only does the likelihood of catastrophic fragmentation consistently exceed predictions by DAS, but the environmental impact may also be greatly underestimated for spacecraft more massive than 50kg.”

The study suggests a new tool that reads in both debris size and relative velocities — namely, mission-specific debris flux data — might offer an improved ability to measure collision probability. In the use of the new Astroscale Tool for Risk Evaluation of Impacting DEbriS (ATREIDES) product, which runs a model to predict potential outcomes while incorporating random variables — known as a Monte Carlo simulation — to generate the probability of catastrophic collision, the probabilities of collision are increasingly higher than expected.

Beyond developing technologies to more accurately predict the probability of collision, we must also account for the limited maneuverability of most satellites. Emerging startup Kayhan Space has developed a solution for NASA’s Global Precipitation Measurement (GPM) spacecraft that generates realistic predicted covariance to determine the collision risk for close approach events following the GPM’s existing maneuverability, similarly validated by Monte Carlo simulations. The SpaceNav paper “Realistic Covariance Generation for the GPM Spacecraft” offers lessons for enhanced SSA, supporting the premise that not only are current methods of calculating the probability of collision underestimated but that current methods to assess the true level of dispersion in predicted spacecraft trajectories are also underestimated.

These findings suggest existing methods for assessing the risk of a collision and its resulting effects are being outpaced by the rapid increase in space environmental use, with an increased likelihood of an unpredicted loss.

The value of space continues to grow

The call to action on SDM is clear, and has the attention of public sector authorities. The U.S. Space Force has sought solutions for orbital debris management as part of its Orbital Prime initiative. The call for STM is not being made with the same authority, urgency or funding. The exigency of technologies that could enable an updated STM policy may best be illustrated by measuring the economic impact of a space collision.

The probability of collision is only likely to increase as the volume of spacecraft grows, which in turn is driving a reassessment of risk tolerance from insurers. According to AXA XL, approximately $35 billion worth of assets are in LEO, but only 8% are currently insured. Insurance firm Assure Space, a unit of AmTrust Financial, stopped providing insurance to spacecraft in LEO in 2020, and the few policies it has sold since then exclude collision damage. Co-founder Richard Parker told Reuters: “This is a real issue for insurance… It may start to get difficult to get that type of coverage in the near future as more insurers realize that this is a significant risk that we can’t even get our arms around.”

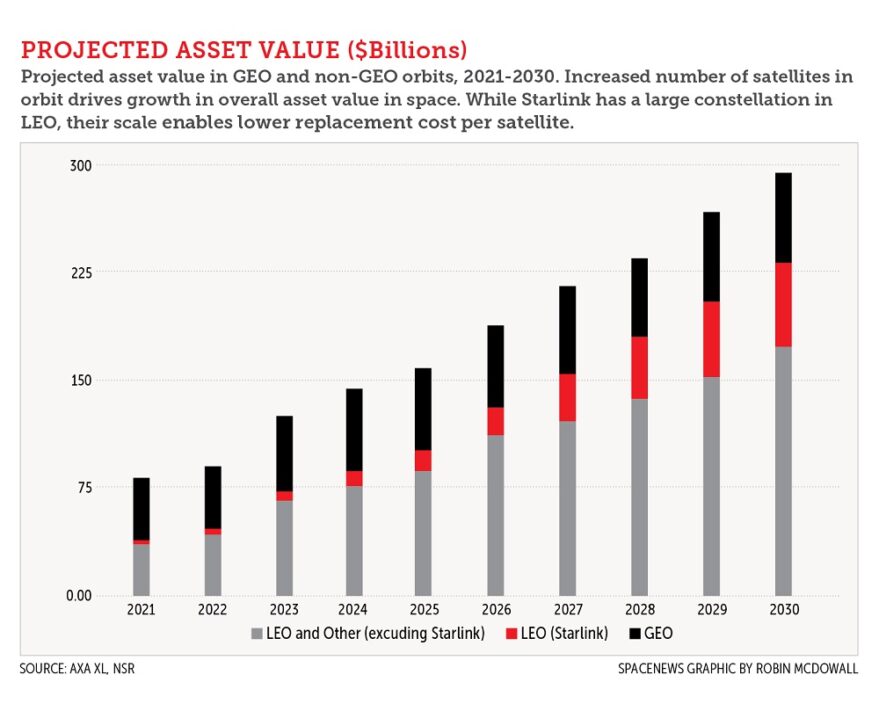

Chris Kunstadter of AXA XL has quantified the value of space-based assets in each orbital regime, leveraging a heuristic referred to as the “K Factor.” Current estimates suggest that the value of satellites differs based on their orbit. GEO satellites have a per-kilogram value of $26,000, MEO satellites are valued at $50,000 per kilogram, and LEO satellites are valued at $43,000 per kilogram — although there are in each of these cases significant variations. To underwrite insurance for each payload, Kunstadter applies the K factor to determine the approximate replacement cost. This metric offers some guidance on what the space economy would suffer as a direct loss in the event of a space collision. The calculus indicates even greater indirect losses such as loss of revenue and business interruption potentially suffered by other segments of the global economy which rely on space technology, such as satellite connectivity, Earth observation, and Position, Navigation, and Timing services.

Beyond insurance coverage, improving spacecraft protection and resiliency is costly. The Organisation for Economic Co-operation and Development noted in a 2020 report, Space Sustainability: The Economics of Space Debris In Perspective, that protecting space systems against debris involves incorporating design measures, ensuring effective surveillance and tracking, moving satellites to avoid potential collisions, and even replacing missions. The report notes that protection and mitigation against collision risks for GEO satellites account for 5-10% of their total mission costs. In contrast, the costs for satellites in LEO may be significantly higher, potentially hundreds of millions of dollars. Furthermore, commercial space object tracking company LeoLabs estimates that a major collision in LEO could reduce the average lifespan of spacecraft in the 650-1,050-kilometer altitude range of LEO by 10%.

If insurance and operational costs are already critical factors driving economic choices in the current operating environment, they become even more so in projected scenarios for 2030, where there may be more than 52,000 satellites in LEO alone, and a further 1,000 in GEO, according to analysis of projections based on data from AXA XL and Northern Sky Research. The total asset value of these satellites may be as high as $230 billion, up from $38 billion today.

We estimate the rising collision risk will see potential asset losses grow to $1.9 billion by 2030, up from just $65 million today. In light of its projected healthy growth over the next two decades, the financial burden of these potential losses would be highly disruptive to the space economy. They would increase barriers to entry for startups, accelerate costs for space-based service providers, drive insurers out of the market, and reduce the appeal for investors who have helped drive the growth of the satellite industry.

Without a supportive market that incentivizes the development and rapid fielding of space environment technologies produced by firms such as Astroscale, LeoLabs, Kayhan Space, Scout, and Privateer, among others, operating conditions may see the space sector wither before it has had the opportunity to realize its full potential.

Space Traffic Management technology is a must to protect space economic growth

The rapid fielding of STM technologies must be prioritized immediately to protect the value of those assets already in orbit and those expected to be launched in the next 5-10 years. Today, industry continues to develop solutions to assist a satellite in identifying the nature of another satellite, object of space junk, or national security space asset as part of emerging space asset detection solutions. The industry is also developing solutions to assist a satellite in maneuvering in the event of a proximal collision.

For example, Kayhan Space has developed the Pathfinder, a comprehensive spaceflight safety toolset that provides autonomous satellite collision avoidance solutions which could enhance and standardize procedures for collision avoidance maneuvers among commercial spacecraft. Other providers of parallel technologies include Scout Space’s satellite data integration platform, which monitors objects in orbit, and Privateer’s Wayfinder, Steve Wozniak’s open-access and near real-time visualization of satellites and debris.

These technologies are driving the increase in offerings to commercial spacecraft manufacturers looking to accurately identify other objects in space, predict how they will move in correlation to their own, mitigate collision risk, and offer bespoke maneuvering methodology to their customer base. This technological advance is especially critical for satellite communications providers like Starlink and OneWeb. LEO broadband stands to be the next generation of connectivity for a multitude of use cases, from precision agriculture to mining and maritime fleet connectivity.

In the absence of rules or guidelines about which satellite has the “right of way” and which government agency has the authority to dictate which satellite must move “out of the way,” the technology itself bears the responsibility of protecting each satellite and its greater value. As such, satellites must correctly identify objects in their path, establish rules of “engagement,” know when to move, maneuver effectively, and know where they need to go. Maneuvering technologies, and complementary capabilities to make effective use of available data, will be critical to ensuring this.

Beyond these capabilities, Space Traffic Management use cases demanding industry financing include technology that enables rapid communications with the eventual governing agencies to provide real-time instruction to the satellites, instructing them to maneuver or de-orbit. The viability of these and other emerging use cases may depend on it.

Applicable lessons and conclusion

Both government and industry have critical roles to play in supporting the development of STM technologies. Government can provide support through funding research and development programs and offering other financial incentives to industry partners focused on developing STM technologies. The aforementioned budgetary allocations toward these capabilities in the Departments of Commerce and Transportation are a good start for the U.S. Moreover, sovereign governments must rapidly identify where the authority lies to identify a satellite or an piece of space debris accurately and, in the case of the former, tell the given satellite what to do or where to go. Efforts in the U.S., such as those led by the Office of Space Commerce, are a step in the right direction and must be empowered with clear authority.

Furthermore, the U.S. government agencies tasked with the mandate must also prioritize STM capabilities in procurement and operations — requiring authorities for procurement, and a clear signal from the strategic governing body (such as the National Space Council) of where those authorities lie. Government-owned assets must be capable of maneuvering and de-orbiting. When procuring services from commercial entities, the governing agency must insist that commercially owned assets have the same capabilities.

Government entities can also continue developing SSA capabilities and making the data collected on the location of assets in space as widely available as possible to preserve the access to space that STM demands while balancing the need for the commercial space industry to protect data obtained with proprietary technology. Such push from the government will help focus the investment efforts of commercial entities.

Rather than waiting for government, however, the commercial space industry would do well to focus investment dollars on developing STM-enabling technologies until the regulatory framework is fielded and adopted. The industry should develop and field competitive technologies for asset identification, predictive analytics on how those assets may ultimately move in real-time, bespoke protocols for response depending on the nature of the space object, and maneuverability. The role the market should play is to invest in developing technologies that would provide these capabilities of STM to commercial and government customers worldwide, with the backing of government agencies and customers that will increasingly require it.

The market for providers such as Astroscale, LeoLabs, Kayhan Space, Privateer, Scout, and others is rapidly increasing. The quantification of potential economic loss in the event of a space conjunction or collision sheds light on how much of our global economy depends on leveraging space environment providers.

Savvy corporations looking at their technology roadmaps would be wise to pay close attention to integrating Space Traffic Management Services alongside satellite communications and Earth observation into their supply chain today to protect their prospective space assets and their corresponding long-term value.

Indeed, protected growth of the space industry — and every use case it powers, from the well-established to the emergent — demands effective STM technology now.

S. Sita Sonty is partner and associate director at Boston Consulting Group, and leads commercial space for BCG. Cameron Scott is knowledge expert for BCG’s defense & security topic. Troy Thomas is managing director and partner for aerospace and defense. Sarah Zhou is an associate in BCG’s Washington office.

This article originally appeared in the May 2022 issue of SpaceNews magazine.