Lockheed Martin completes acquisition of smallsat manufacturer Terran Orbital (Image Credit: Space News)

WASHINGTON — Lockheed Martin Corp announced Oct. 30 it has completed the acquisition of small satellite manufacturer Terran Orbital. The approximately $450 million acquisition deal deepens Lockheed Martin’s foothold in the commercial satellite sector and culminates a partnership that began in 2017.

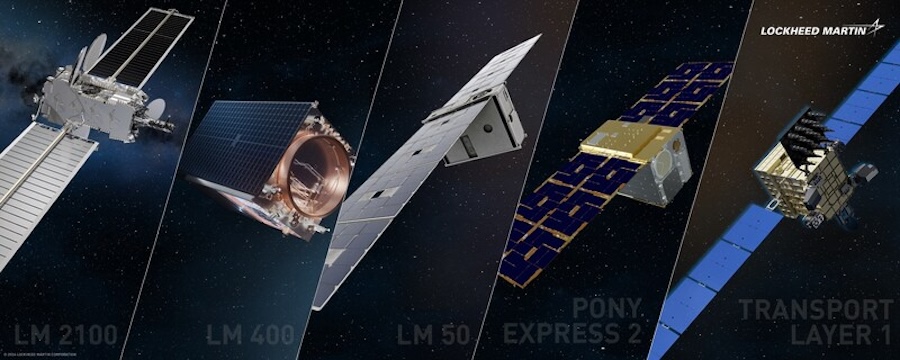

The acquisition positions Lockheed to leverage Terran’s expertise in low-cost satellite production for both military and commercial ventures. Lockheed Martin stressed that Terran Orbital, now rebranded as “Terran Orbital, a Lockheed Martin Company,” will continue to operate as a merchant supplier for the broader space industry.

The completed acquisition caps Lockheed Martin’s years-long relationship with Terran Orbital, formerly Tyvak Nano-Satellite Systems. The smallsat specialist, founded in 2011, initially focused on nanosatellites and cubesats, but transitioned to building larger satellite platforms after it rebranded in 2022. That shift in focus followed Terran Orbital’s public listing through a special purpose acquisition company (SPAC) merger, which aimed to accelerate its commercial growth.

The partnership’s early days saw Lockheed Martin Ventures, the company’s venture capital arm, make its first investment in Terran Orbital in 2017. Since then, Lockheed incrementally increased its stake, reaching roughly one-third ownership through a series of investments in 2020 and 2022.

During this period, Lockheed Martin integrated Terran Orbital’s satellite buses into military projects, including a low Earth orbit satellite program spearheaded by the Space Development Agency. Lockheed and Terran have also collaborated on a series of Lockheed-funded technology demonstrations aimed at national defense and intelligence agencies.

Learning from the commercial side

Terran Orbital brings specific automation and manufacturing processes that Lockheed hopes to adopt for its own satellite production lines, according to Chris Moran, head of Lockheed Martin Ventures. Speaking earlier this month on the SpaceNews Commercial Space Transformers series, Moran said that Terran Orbital’s approach to automation has allowed it to achieve impressive efficiencies in satellite manufacturing.

“Terran Orbital has created a lot of automation around certain build cycles that I think we can benefit from, even on satellites that we make,” Moran said. “They’ve been able to automate things that no one would have imagined could be automated, and that’s something that we can apply to our own processes.”

He emphasized the value of combining Lockheed Martin’s extensive defense contracting experience with Terran Orbital’s commercially focused engineering.

Financial challenges for Terran Orbital

Lockheed Martin’s acquisition, announced Aug. 15, follows a challenging financial period for Terran Orbital, whose revenue goals and growth ambitions were hindered by cash flow issues earlier this year. Lockheed’s initial buyout offer of $1 per share in March 2024 was rejected by Terran, which later agreed to a revised deal at $0.25 per share and the assumption of outstanding debt obligations.

Lockheed Martin Space President Robert Lightfoot praised the acquisition: “We welcome their ingenuity and dedication to ensuring mission success, and we’ve always valued those aspects of our working relationship,” he said in a statement.

Terran Orbital’s footprint spans multiple U.S. locations, including Boca Raton and Melbourne, Florida; Irvine and Santa Maria, California; and Atlanta, Georgia, with an international base in Torino, Italy.