Hiber demands Astrocast cash after failed acquisition (Image Credit: Space News)

TAMPA, Fla. — Dutch remote monitoring specialist Hiber is demanding $1.5 million from cash-strapped Astrocast after plans to be sold to the company ran out of time, according to the Swiss small satellite operator.

The acquisition was tied to Astrocast’s plan to list shares on the Euronext Growth Paris junior stock market in France, which Hiber agreed to invest in, and was subject to a Nov. 30 deadline.

Astrocast announced plans to buy Hiber half a year ago and had hoped to complete its offering of shares by this summer before running into volatile financial markets.

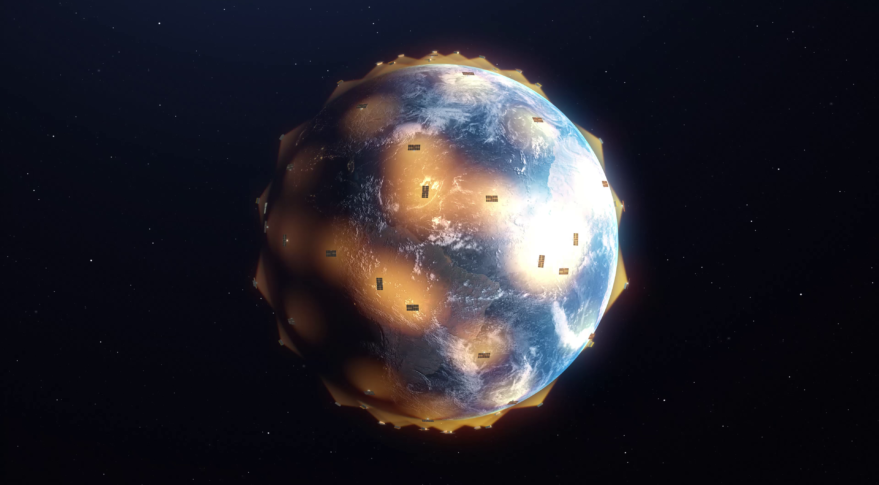

The Swiss company connects internet of things devices in remote areas with a constellation of 14 operational satellites, and planned to use spectrum Hiber leases from Inmarsat to expand to the Americas to provide services globally.

Hiber provides satellite-connected devices and solutions that enable customers to monitor and track assets in remote locations, with a particular focus on the oil and gas industry — a key growth area for Astrocast.

In May, Astrocast said it needed to raise 43 million Swiss Francs ($45 million) this year to fund expansion plans for growing its fleet to 20 satellites before the end of 2022, and to 40 in 2023 to improve coverage.

In a Nov. 24 announcement signaling Hiber’s intent to terminate their deal, Astrocast said it has been using short-term debt from existing investors to fund current operations.

The Swiss operator added that it is assessing “strategic alternatives for strengthening its financial position on a long-term basis.”

Kjell Karlsen, Astrocast’s chief financial officer, told SpaceNews: “We have a target and feel confident that we will reach this based on ongoing discussions with existing and new investors.”

The operator still plans “an eventual listing” of shares in France without Hiber’s support, Karlsen added, although there is no current timeframe.

He declined to detail Hiber’s financial claim, which is part of “certain areas of the purchase agreement that are being disputed.”

Astrocast said Hiber is seeking mediation to resolve the dispute under an arbitration process and the Swiss company is assessing “all legal remedies to support its position.”

Hiber declined to comment on the dispute.

Fabienne Pinot, Hiber’s marketing director, said the Dutch company had been set to close the sale “immediately” following Astrocast’s stock listing in France, before it missed its deadline.

Astrocast already trades shares in Norway, where it raised $42 million by listing them on the Euronext Growth Oslo stock exchange in August 2021.

The operator launched initial commercial services in February. Its latest batch of four satellites, each the size of three cubesats, were deployed Nov. 26 as a secondary payload aboard India’s Polar Satellite Launch Vehicle rocket.

Karlsen said this successful launch will aid the company’s discussions with investors.

More satellites enable the company to improve coverage and satellite revisit rates. Astrocast ultimately aims to operate 100 of them in low Earth orbit.

In August, Italy’s D-Orbit said it struck a deal to use its orbital transfer vehicle to launch 20 Astrocast satellites over a three-year period.

Karlsen said D-Orbit is slated to deploy four satellites for Astrocast in late December on a Falcon 9 rideshare mission.

“That is it for this year,” he said, adding: “We are evaluating our launch plans for 2023 as we are meeting our customer needs with these satellites in orbit.”

According to Karlsen, the company has also “partially funded” four more satellites “and the launch for them as well”.

Astrocast recently recorded 287,000 Swiss Francs in revenues for the six months to the end of June, down from 824,000 Swiss Francs for the same period in 2021 — a year it benefited from a European Space Agency development contract.

The company reported a 9.1 million Swiss Franc loss for the first half of 2022 in EBITDA — or earnings before interest, taxes, depreciation, and amortization — compared with a loss of 5.5 million Swiss Francs for H1 2021.

At the end of June, Astrocast said it had a cash balance of 553,000 Swiss Francs.