Geospatial analysis provider Descartes Labs sold to private equity firm (Image Credit: Space News)

TAMPA, Fla. — Private equity firm Antarctica Capital has acquired geospatial analytics provider Descartes Labs to support its growing space-based data portfolio.

Antarctica said Aug.4 it bought a controlling stake in Descartes for an undisclosed sum in a news release that offered few details about the deal.

As part of the transaction, Antarctica operating partners Richard Davis and Graeme Shaw will serve, respectively, as Descartes’ CEO and chief operating officer of Descartes.

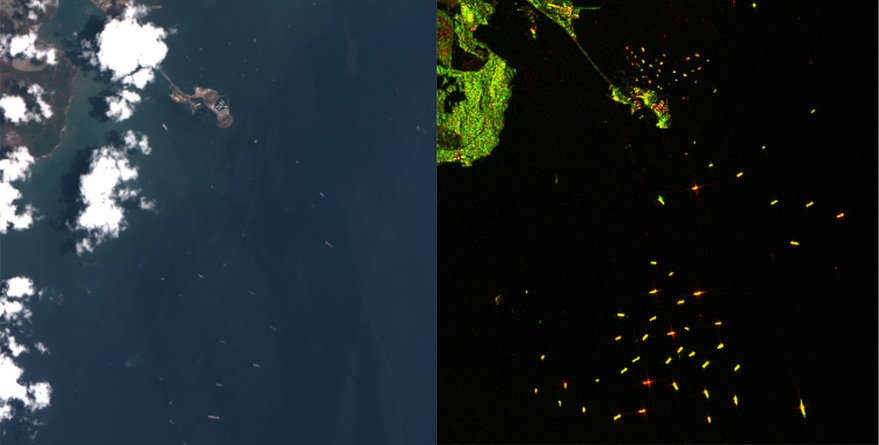

Descartes provides analysis from a mix of third-party satellites with a cloud-based platform that helps companies make forecasts related to agriculture, energy, sustainability, mining, shipping, financial and other services.

The Santa Fe, New Mexico-based company also supports government customers in processing multi-source geospatial data.

In 2020, Descartes said it had secured a $1.5 million contract to help the U.S. Air Force draw intelligence from imagery and other data collected by satellites and autonomous aerial vehicles.

Descartes was spun off from the U.S. Energy Department’s Los Alamos National Laboratory in 2014.

Antarctica managing partner Chandra Patel said the New York-based private equity firm has a “strong institutional commitment to the geospatial and data analytics sectors,” and Descartes “will be very complementary to our other portfolio companies in these sectors.”

Antarctica formed a Canadian optical satellite imagery provider called EarthDaily Analytics (EDA) last year after buying parts of UrtheCast that sought creditor protection to avoid bankruptcy.

The private equity firm bought satellite designs, software, customer contracts, intellectual property from the company, but did not buy its satellites or synthetic aperture radar (SAR) assets.

EDA said Jan. 18 it had picked condosat operator Loft Orbital to build, launch and operate a fleet of 10 Earth-observation satellites in 2023.

According to EDA, the constellation’s sensors will cover a broad spectral range from visible to thermal wavelengths for markets that include agriculture and commodity trading.

Antarctica, which manages more than $2 billion of assets, and told SpaceNews last year that it was in talks about buying other businesses in complementary areas.

The private equity firm is also behind a special purpose acquisition company (SPAC) called Endurance Acquisition Corp, which plans to merge with Israeli satcoms equipment maker SatixFy this year.

Endurance raised about $200 million for the deal in September by listing shares on the Nasdaq Capital Market.