HawkEye 360 plans new funding round as it positions to go public (Image Credit: Space News)

WASHINGTON — Following a surge in demand for the company’s services during the war in Ukraine, HawkEye 360 is looking at a new round of funding, and possibly going public in a couple of years, CEO John Serafini said Sept. 8.

Earth observation company HawkEye 360 uses satellites to monitor radio frequency (RF) signals emitted by electronic devices and analyzes the data to draw conclusions.

“We’ve performed over 1,000 individual missions over Ukraine, and it’s given us bona fides that we can then go take to other places where we’re required, in particular Asia Pacific with the rise of China,” Serafini said at an aerospace and defense symposium in New York City hosted by the investment advisory firm Gabelli Funds.

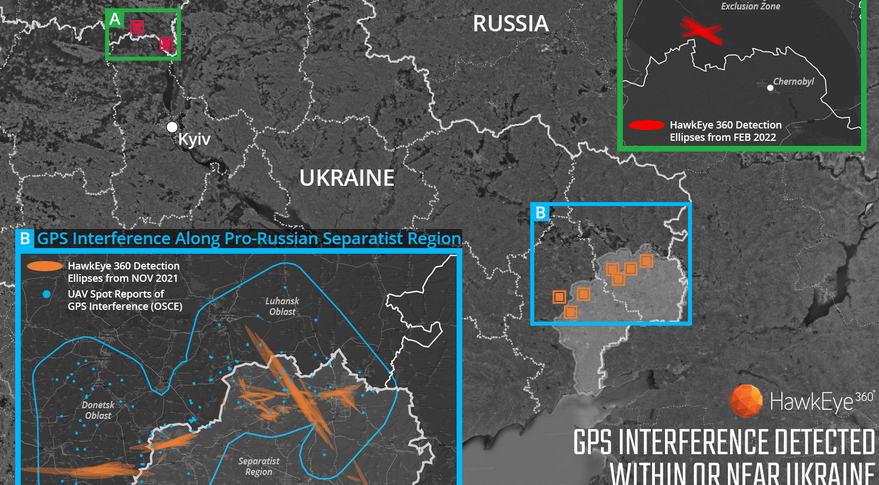

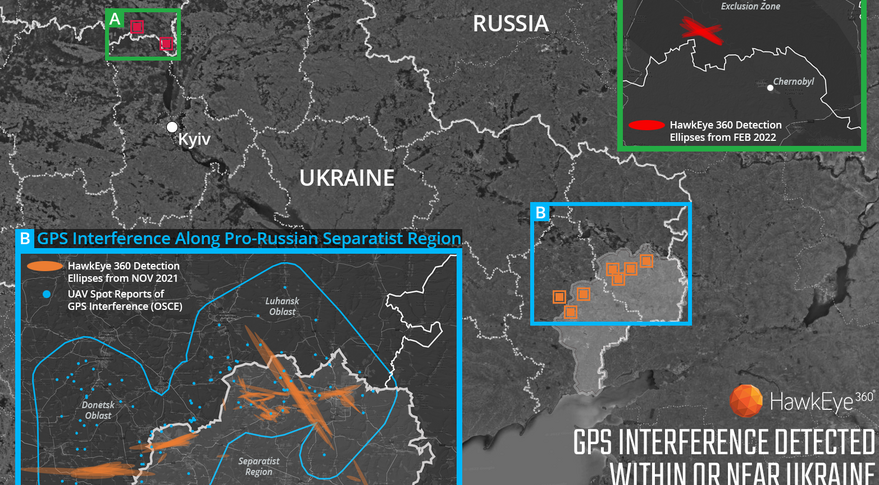

Of particular interest to military and intelligence agencies is the use of RF detection to locate sources of GPS jamming or other activities that disrupt satellite-based navigation. HawkEye 360 in March reported its satellites over Ukraine detected extensive GPS interference activity.

Serafini said HawkEye 360 is planning a new funding round and perhaps an IPO, depending on market conditions. An almost exclusive focus on U.S. and international military and intelligence customers makes the company less vulnerable to the swings of the commercial markets, he said.

“We service recession resistant customers that are going to spend billions upon billions of dollars to get what they need regardless of recessionary conditions elsewhere in the world,” said Serafini. “We are very focused on government centric defense, intelligence and security missions, not just for the U.S. government, but for our international allies as well.”

Since the company was founded in 2015, HawkEye 360 has raised more than $300 million in six funding rounds.

“As we contemplate our next round, I think we will continue to look for private sources of capital, particularly for perhaps a pre IPO round, in anticipation of an IPO likely in 2024 or 2025 depending upon the macro conditions,” he said.

The economic trends of late — rising interest rates, soaring inflation and uncertainty driven by the ongoing war in Ukraine — have been unfavorable for commercial space and data analytics companies seeking to go public. Space logistics company D-Orbit last month canceled plans to go public by merging with Breeze Holdings Acquisition Corp., a special purpose acquisition company (SPAC). Earlier this year, weather and climate security platform Tomorrow.io and special purpose acquisition company Pine Technology Acquisition Corp also terminated a SPAC merger agreement due to market conditions.