GAO: Defense, intelligence agencies need a better plan to buy commercial satellite imagery (Image Credit: Space News)

WASHINGTON — Despite a growing demand for satellite imagery, U.S. defense and intelligence agencies are not taking advantage of available commercial technology due to slow and cumbersome procurement methods, the Government Accountability Office said in a Sept. 7 report.

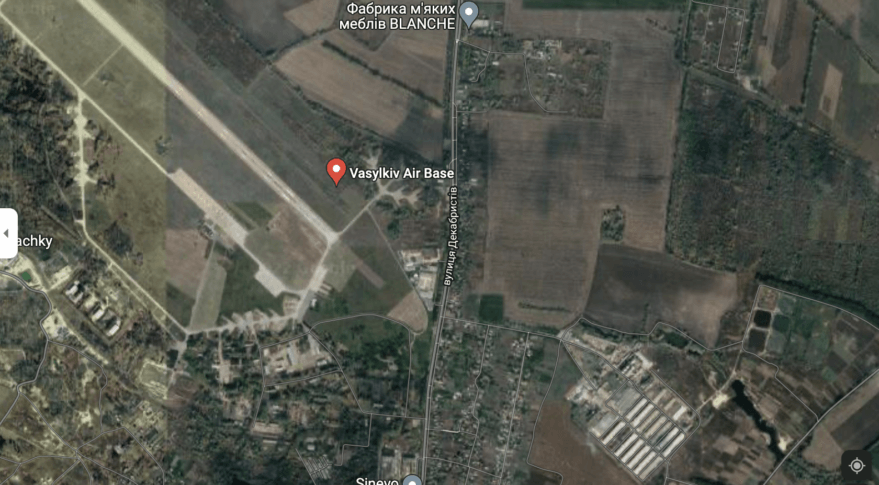

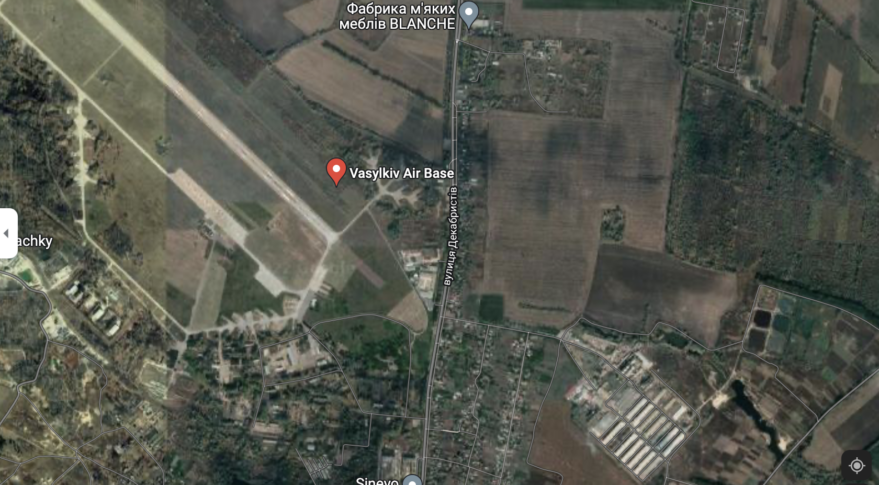

The war in Ukraine has drawn attention to how governments are using commercial satellites to track troop movement and the impact of attacks. Meanwhile, the U.S. intelligence community and the Department of Defense continue to do business as usual and are not incorporating emerging commercial capabilities, said the report directed by the House and Senate intelligence committees.

“Until they address this, the U.S. risks losing a technological advantage over emerging competitors, like China,” said GAO.

The National Reconnaissance Office, the agency that operates the nation’s classified spy satellites and also is responsible for buying commercial imagery, has for years been working on a strategy to acquire emerging commercial capabilities. But during that time the commercial sector has flourished and the government’s procurement strategy is behind the curve, said Brian Mazanec, GAO’s director of defense capabilities and management and author of the report.

“We found that the current approach faces challenges incorporating the rapidly improving commercial capabilities, both in terms of timeliness and scaling,” Mazanec said. “The commercial satellite imagery industry continues to rapidly change so finding ways the government can take advantage of that continuous innovation is difficult.”

The IC and DoD for the most part continue to use their standard process for buying products and services, “which isn’t fast,” he said.

From 2019 through 2021, the report said, the NRO spent some of its commercial imagery budget on emerging capabilities, but those efforts have not generally led to sustained funding. Study contracts with small dollar amounts “limit the ability of vendors to expand and enhance service offerings.”

Imagery analysts at the National Geospatial Intelligence Agency (NGA) also face challenges integrating data from commercial satellites, according to the report. “For example, NGA officials reported that, although NRO has a number of study contracts exploring commercial radar capabilities, NGA does not have formal requirements to ingest and process this commercial radar data in their ground systems from these emerging capabilities.”

Mazanec noted that NRO spending on commercial imagery for foundational mapping is “quite significant” and has allowed the NRO to focus on other capabilities. However, DoD and the IC “have a really hard time incorporating emerging commercial capabilities at scale and in a timely manner.”

He said GAO investigators spoke with about a dozen commercial vendors. Those that only have research and development contracts “expressed genuine frustration with the long lead time in the process. They also found that the small study contracts rarely translated into larger government commitments.”

Lack of coordination between DoD and IC

GAO also highlighted a lack of coordination between DoD and the IC on imagery requirements. This fragmented approach, said the report, results in overlapping wish lists and procurements.

“We found that the IC and the DoD need to establish clear roles and responsibilities for the acquisition of commercial satellite imagery, and then communicate this to all the relevant stakeholders,” said Mazanec.

The NRO and NGA, for example, have written agreements documenting specific responsibilities among their two agencies. “However, once you get outside of NRO and NGA, there’s no guidance that addresses organizational roles and responsibilities across the IC and DoD related to commercial satellite imagery. And this is particularly problematic with the U.S. Space Force coming online and developing its service specific mission areas and focus.”

The report has four main recommendations: The IC and DoD should lay down clear roles and responsibilities for acquiring commercial satellite imagery. They should figure out how to scale emerging commercial satellite capabilities into operational support contracts in a timely manner. The third one is to set performance goals and measures towards maximizing the use of commercial satellite imagery. Finally, the IC and DoD should provide better guidance for the use of commercial analytics services that use remote sensing data.

“Our bottom line is that commercial satellite capabilities are increasingly going to be indispensable to the national security enterprise,” said Mazanec. “We really believe that if DoD and the IC can develop an effective approach to incorporate and sustain emerging commercial satellite capabilities in a timely manner, the national security enterprise will be better positioned to maintain and grow its technological advantage in space.”