First, a ULA sale process, now Starliner.

Boeing is considering putting Starliner and its space station operations business up for sale, according to a report by the Wall Street Journal.

A month after Starliner returned from the ISS without its astronauts, the aerospace giant’s new CEO Kelly Ortberg hinted at life without its troubled crewed spacecraft during the company’s Q3 earnings call last week, saying “Boeing is an airplane company” and “We’re better off doing less and doing it better, than doing more and not doing it well.”

Boeing reported a $250M loss on Starliner in Q3, bringing total program losses to nearly $1.9B. The company appears no longer willing to throw more money into the project.

ULA is still on the block: The company is reportedly still interested in keeping its SLS *cough cost-plus* contract but has been looking to offload ULA for a year and a half. The rocket JV with Lockheed Martin is reportedly valued between $2B and $3B and has received interest from Blue Origin, Cerberus, and Sierra Space… but still no takers.

Starliner and ISS station ops may be just as difficult to sell as the pool of potential buyers for the often-troubled $5B spacecraft is small. However, there are a couple of homes for Starliner that could make sense.

Here is the Starliner investment case and a list of potential acquirers.

Reasons to Buy Starliner?

Post-R&D on the horizon: A buyer would have the opportunity to scoop the spacecraft up after the vast majority of its R&D has been completed.

- Developing Starliner has cost over $5B, with both NASA and Boeing sharing the expenses.

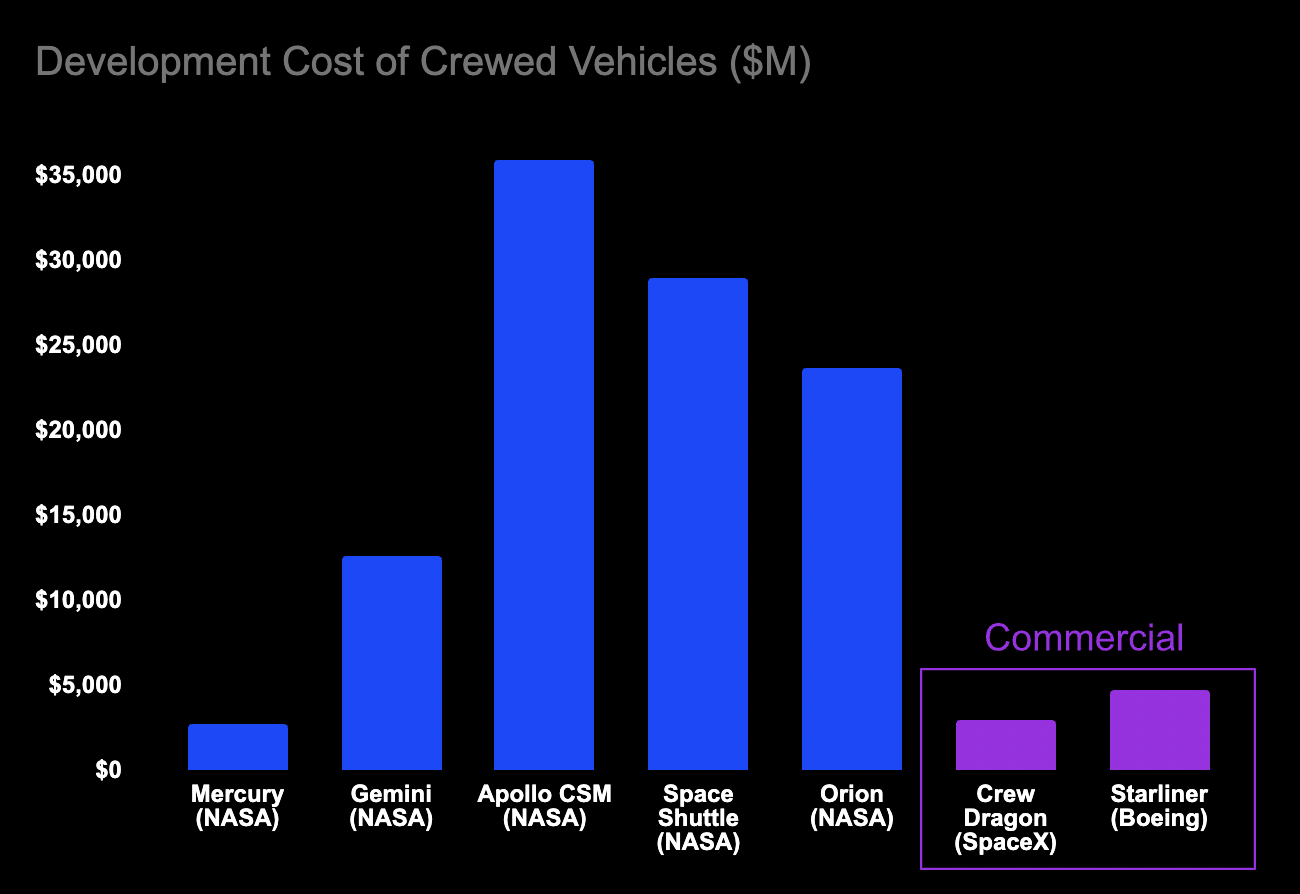

- The price tag is significantly higher than that of SpaceX’s Crew Dragon, but it is well below the historical cost of NASA crewed vehicles.

- While the program recorded a $250M loss this quarter, the high R&D costs are largely behind it. Starliner returned safely to Earth without astronauts last month—although it did have an issue with one of its 12 thrusters.

- A buyer could wait until after Boeing addresses the Starliner thruster issues or even after NASA green-lights certification for operational missions. This would give an acquirer a *relatively* clean slate to start executing on up to six NASA flights.

- The acquisition cost would likely be well below the amount of R&D put into Starliner.

NASA support: NASA is fully committed to Starliner as the agency needs two operational crewed vehicles to create competition with SpaceX’s Crew Dragon (yes, it is tremendously ironic given how the roles were reversed at the program’s outset). The agency could also find creative ways to support and incentivize the continuation of the Starliner program online.

Competitive dynamics: After years of development and certifications, the asset has developed deep moats. Starliner faces very few competitive threats, creating a clear path forward to continue winning large NASA contracts. In 2019, NASA’s inspector general pegged Starliner’s cost per seat at $90M. NASA currently pays SpaceX over $70M per seat.

Reasons Not to Buy Starliner?

Risk of further costs and headaches: The heavy R&D may be behind Starliner, but that necessarily doesn’t mean it won’t encounter more issues in the future.

- Boeing has recorded nearly $2B of losses on the program, including $250M last quarter.

- Starliner has been plagued with issues involving its software, valves, flammable tape, parachutes, and thrusters.

- Only a few entities could stomach the risk and financial consequences of another issue creeping up.

ISS retirement and commercial stations: The ISS is slated to be decommissioned in ~2030. It is still to be determined whether a commercial space station will be operational by that time, which could limit the need for astronaut transport. Furthermore, commercial stations will have greater flexibility in selecting a spacecraft for astronaut transport, potentially reducing demand for Starliner.

Vibe check: While the company has a long track record in space, Boeing’s space segment is not known for having the scrappy and risk-forward culture coveted in an industry where innovation and cost controls are paramount. As a result, Boeing has had difficulty attracting top talent.

Political and agency shakeups: The sale of Starliner would occur after the presidential election, which could come with an administration and priority change. A potential buyer would need assurance from the Harris or Trump administration that NASA is still committed to dual LEO spacecraft suppliers.

Potential Buyers

Blue Origin

Blue Origin is the most compelling home for Starliner. In fact, the WSJ reported Boeing has already begun discussions with Blue Origin. The acquisition may make sense:

- New Glenn could use a crewed capsule

- Blue Origin’s Orbital Reef space station has already partnered with Starliner

- The company is committed to human spaceflight and has the resources to stomach bumps along the way

- Buying a crewed spacecraft is likely easier than spending years building and certifying their own

Blue Origin would likely get a sweet deal for Starliner and could even explore a way to package Starliner with ULA while they are at it.

However, there are just as many reasons why Blue Origin would be hesitant to buy the asset, much like how they’ve seemingly thought twice about a potential ULA acquisition. The reasons include:

- Culture fit: Sources tell Payload Dave Limp has lit a fire under Blue Origin since he took the helm in late 2023, galvanizing a sense of urgency in the company. The innovative and decisive culture that Limp and Bezos are instilling at Blue does not necessarily align with Starliner’s reputation.

- In-house crewed capsule: The company has been covertly developing its in-house crewed capsule, increasingly prioritizing the project. The spacecraft leverages tech from existing projects like Blue Ring and New Shepard crew capsule and then inform future projects like Orbital Reef.

- A question of prioritization: The company has its hands full with New Glenn, Blue Moon, and engine production and may not want to spread itself too thin.

Aerospace Primes

Boeing is not the only aerospace prime becoming more selective with its space operations. After years of heavy losses, the primes have begun to take a hard stance against fixed-cost contracts (such as Starliner’s) and to exit unprofitable contracts (like Collins did with its NASA spacesuit business).

Aerospace primes are risk-averse and less vertically integrated, often leading to higher overall costs. An excellent example of this is ULA’s Vulcan rocket development costs. ULA chief Tory Bruno recently revealed it cost $5-$7B to develop Vulcan. Compare that to Rocket Lab, which targets a $350M development cost for its partially reusable medium-lift Neutron rocket.

With aerospace primes becoming more selective, it is unlikely that one will want to acquire an unprofitable and uncertain Starliner business.

A European company could also be interested in Starliner; however, this would raise plenty of export control questions. Although US to European aerospace business sales are possible—for example, Paris-based Safran is in the process of acquiring US-based Collins Aerospace’s actuation and control business for $1.8B.

Rocket Lab

In a September 2022 investor presentation, Rocket Lab hinted at getting into the crewed capsule business. The company has a history of growing through acquisitions, and tucking in Starliner—for the right price—could be an appealing way to expand into the market. The company designed, built, and operated Varda’s spacecraft, allowing the team to gain valuable experience in reentry operations.

However, Rocket Lab has been mum on crewed vehicles since that presentation, turning its 5 year roadmap focus instead to expanding into operating an in-house constellation.

Rocket Lab has been prudent with shareholder capital, and even if they could raise the capital, management will likely view Starliner as too high of a financial risk.

Sierra Space, Axiom, Firefly

Sierra Space, Axiom, and Firefly compete in human spaceflight-tangential markets. It is unlikely, however, that any of them has the capital needed for the acquisition—or the interest, for that matter. Axiom has reportedly struggled with liquidity, and Firefly hasn’t expressed a desire to jump into human spaceflight.

Sierra Space could be a consideration since they have reportedly had talks with Boeing and Lockheed regarding the ULA sale, but Starliner is likely outside their strike zone. Besides, they’ve spent years developing their space vehicle, Dream Chaser, which is set to fly a cargo mission to the ISS next year.

Billionaire Out of Left Field

Space 🤝 billionaire is a combination as old as space time itself. Starliner could represent an opportunity for a billionaire who wants to enter the space domain and feels they can reenergize the program.

PE Shop

It is unlikely that a private equity firm would have an interest in Starliner as it is a single-product, low-cash-flow business with limited growth opportunities. There are examples of private equity firms investing in spaceflight, such as AE Industrial leading Firefly’s funding; however, unlike Starliner, Firefly offers a wide range of services in diverse end markets, making it a stronger candidate for PE dollars.

+ No sale: There’s always the possibility that Boeing can’t find a buyer. Could we see another government-orchestrated merger (+subsidies) like when officials combined Boeing and Lockheed’s rocket business to create ULA? Unlikely, given the US already has reliable astronaut transportation in SpaceX’s Crew Dragon and there is not a systemic national security risk.