SAN FRANCISCO – Terran Orbital, the parent company of Tyvak and PredaSAR, announced plans Oct. 28 to go public through a merger with a special-purpose acquisition company (SPAC) in a deal that includes AE Industrial Partners and Lockheed Martin.

The transaction, expected to be completed in the first quarter of 2022, would list Terran Orbital shares on the New York Stock Exchange with an initial valuation of $1.58 billion.

Terran Orbital is merging with Tailwind Two Acquisition Corp., a SPAC that holds $345 million in capital. A concurrent private investment in public equity (PIPE) round is providing an additional $50 million. Francisco Partners and Beach Point Capital have announced additional financial commitments of $75 million.

PIPE participants include AE Industrial Partners, Lockheed Martin, Beach Point Capital, Daniel Staton and Fuel Venture Capital. Francisco Partners and Lockheed Martin also have made debt commitments of $125 million subject to certain undisclosed conditions.

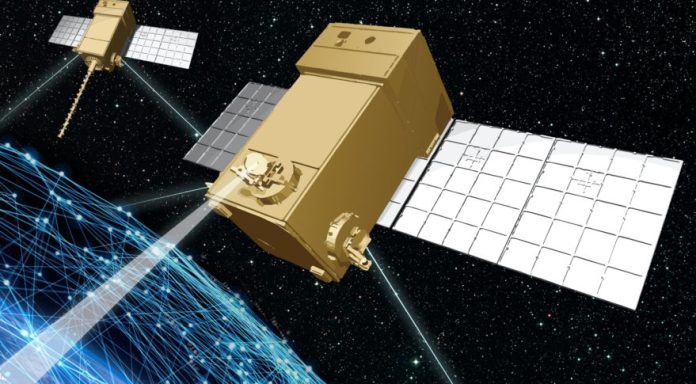

Terran Orbital, a veteran of the small satellite industry, manufactures and operates satellites for commercial and government customers including military and intelligence agencies, NASA and the European Space Agency. The firm has won contracts to build satellites and provide services for more than 80 missions.

Terran Orbital announced an agreement last month with Space Florida to establish a manufacturing facility on Florida’s Merritt Island large enough to produce more than 1,000 satellites per year.

In addition to filling customer orders, Terran Orbital is establishing its own constellation of small Earth-observation satellites to offer customers speedy access to global imagery captured day and night thanks to synthetic-aperture radar.

“With our high volume, innovative manufacturing of small satellites, we will be able to deliver emerging technologies to space faster, more affordably and with greater reliability than anyone,” Marc Bell, Terran Orbital co-founder and CEO who established the company in 2013, said in a statement.

Lockheed Martin Ventures announced a strategic investment in Terran Orbital in 2017.

“We actively pursue working with organizations that are developing disruptive technologies and leveraging alternative business models,” Rick Ambrose, Lockheed Martin Space executive vice president, said in a statement. “Our experience with Tyvak, which is part of Terran Orbital, has helped us expand our core capabilities to enable hybrid, networked architectures and we look forward to continuing to work together for the benefit of our customers.”

AE Industrial Partners is well known in the space sector since it founded Redwire in 2020, a firm that went public through a SPAC merger.

“Small satellites will play a critical role in the future of space infrastructure and exploration, as well as provide customers with real time data to make informed and actionable decisions,” Kirk Konert, partner at AE Industrial Partners, said in a statement. “Terran Orbital is entering into commercial partnerships with BigBear.ai and Redwire to develop and enhance next generation artificial intelligence and space solutions offerings, which is why we’re pleased to back the company and support its future growth.”

The space industry has seen a wave of SPACs in recent months. While not all of the deals have been well received, Bell said he is confident Terran Orbital’s SPAC merger will be successful because “we have real revenues, a real backlog, a real pipeline and real customers.”

Longtime investors, Lockheed Martin and Beachpoint Capital, also are sticking with Terran Orbital, which Bell sees as a vote of confidence. “They continue to follow us,” Bell noted.

Between the recently announced deal with Space Florida and the SPAC, Terran Orbital “has a lot of momentum,” Bell said.

– Advertisement –