TAMPA, Fla. — Early-stage investor Tamarack Global is hunting for more space opportunities after announcing the close of a $72 million fund Oct. 30.

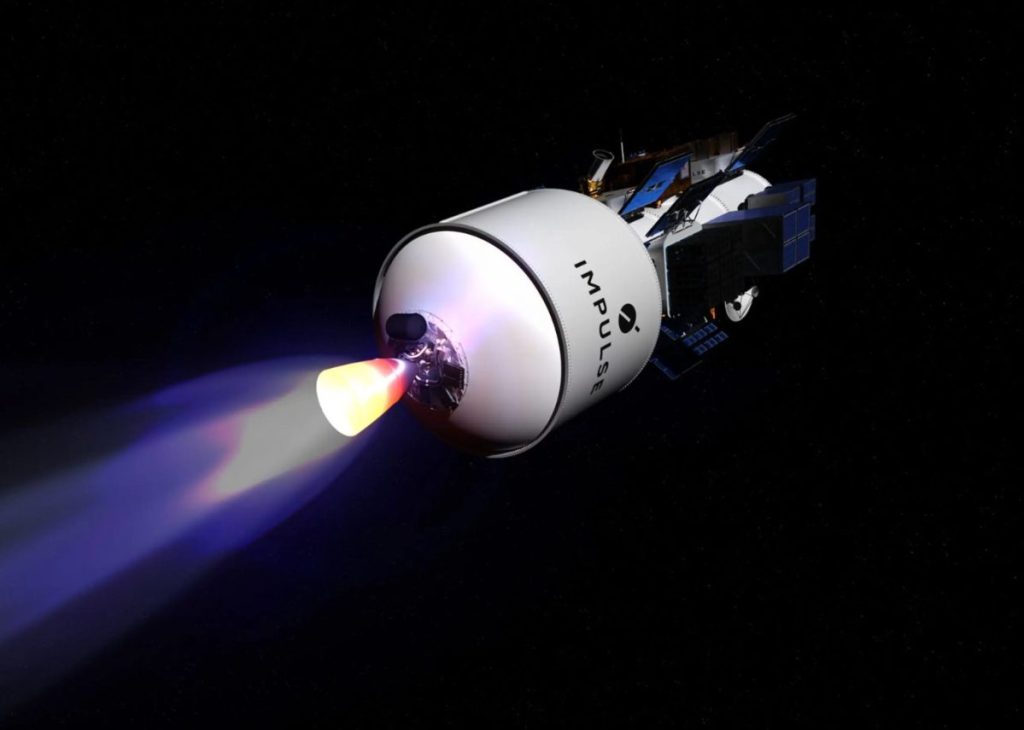

Jamie Lee, co-founder and managing partner of Tamarack Global, said the firm has already allocated about a third of the fund, including to support orbital transfer vehicle developer Impulse Space’s recent $150 million Series B investment round.

“We’re very much open for business and we’ve got a lot of dry powder,” Lee said in an interview.

“We are incredibly bullish on this sector, and we would love to meet and see any and all kinds of new companies that are building in this sector.”

He said Tamarack Global is looking to make investments in companies ranging from early-stage ideas on a napkin to more developed businesses seeking Series B financing.

“And by napkin, I mean if some really smart young man or woman wants to spin it out of SpaceX, and they’ve made a little money and they want to do their own thing [with] an idea on a napkin, that’s prime hunting grounds for us.”

He said support for the fund came from a broad mix of investors, including high-profile venture capitalists such as Mark Andreessen and Chris Dixon of Andreessen Horowitz.

It is Greenwich, Connecticut-based Tamarack Global’s second venture capital fund since being founded in 2019.

According to Lee, about a third of the firm’s first $31 million fund was invested in space-related companies, including spaceplane developer Venus Aerospace and launch vehicle venture ABL Space Systems.

Tamarack Global is looking to make technology investments across four main areas: Aerospace and defense, robotics and autonomy, data intelligence, and energy transition.

Although based in Connecticut, he said the company has built a network of potential space investments in California from an office in Los Angeles.

However, Lee conceded that the space industry remains challenging for investors because of the high failure rate of companies in this market.

“It’s a very hard space to operate in,” he said, “and so some of our learnings from fund one to fund two is that we’re probably going to be more concentrated in our bets, as opposed to sprinkling checks across a number of companies.”

Investors speaking on a Satellite Innovation panel last week in Mountain View, California, said they expect early-stage space companies to continue struggling to raise funds despite lower interest rates.