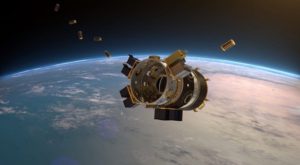

Intelsat loaned the Earth-observation division BlackSky of Spaceflight $50 million, giving the satellite satellite operator a part in Spaceflight’s company. Credit: Spaceflight.

WASHINGTON — Intelsat is currently asking its bankruptcy court to modify a $50 million loan to Spaceflight Industries’ company BlackSky that could become a snag in Spaceflight’s sale of its own launching rideshare enterprise.

Intelsat signed the BlackSky loan Oct. 31, about two weeks before it was publicly announced, according to a bankruptcy record. That exact same afternoon Mitsui & Co. loaned Spaceflight Industries a separate $26 million with an eye toward acquiring its launching rideshare enterprise. In February Mitsui announced it was buying that firm with Yamasa Co., Ltd., who will own it in a 50/50 joint venture.

Intelsat and Mitsui signed an intercreditor agreement where every company employed a part of Spaceflight Industries Spaceflight’s launch and mission control company by Mitsui and the BlackSky company by Intelsat of Spaceflight. Others and that arrangement involving both firms made Mitsui’s purchase of the launch company contingent of Spaceflight upon Intelsat relinquishing its exemptions the collateral of Mitsui.

Ahead of the bankruptcy of Intelsat, Spaceflight said it expected the sale. The Mitsui transaction passed a review by the Committee on Foreign Investment in the United States (CFIUS) on April 22, clearing the price of domestic safety concerns from regulators. The bankruptcy court of intelsat is not expected to listen to the motion on the loan of Spaceflight until June 9, nevertheless.

Jodi Sorensen, vice president of advertising for Spaceflight Inc., the launching arm of Spaceflight Industries, said the company still anticipates the purchase to close soon despite the bankruptcy tie-up.

“The finish of the purchase of Spaceflight by Mitsui is progressing and we hope it will be rearranged soon,” she said by email May 28.

Once Mitsui completes its cost of Spaceflight Industries’ launch company purchase, Spaceflight will use the sale proceeds to pay back the $26 million loan and then utilize any extra proceeds to pay down an undisclosed amount of overdue payments to LeoStella, the joint venture between Spaceflight Industries and Thales Alenia Space tasked with constructing BlackSky’s constellation.

BlackSky is arranging a constellation of 60 satellites, of and eight are expected to start.

Intelsat advised its bankruptcy court the Spaceflight Inc. purchase is fantastic for BlackSky, because proceeds from the purchase”enhances liquidity accessible to BlackSky” and increases the value of Intelsat’s loan.

Intelsat reiterated it sees substantial value in the”synergistic and strategic possible” of pairing BlackSky’s remote sensing firm with its own telecommunications company, a partnership which could bring about joint solutions.

– Advertisement –