TAMPA, Fla. — Swiss startup ClearSpace said Jan. 19 it has raised about $29 million to support its first space debris removal mission in 2026.

Europe-focused early-stage investor OTB Ventures led the Series A financing round along with Swisscom Ventures, the investment arm of Switzerland-based telco Swisscom.

The government-backed Luxembourg Future Fund (LFF) also participated in the round, and ClearSpace said it is establishing an operational presence in Luxembourg as a result.

ClearSpace has now raised about 130 million euros ($140 million) from commercial and government sources to develop its capabilities, according to co-founder and CEO Luc Piguet.

The bulk of these funds come from ClearSpace-1, a 110 million-euro space debris removal mission secured from the European Space Agency (ESA) in 2020.

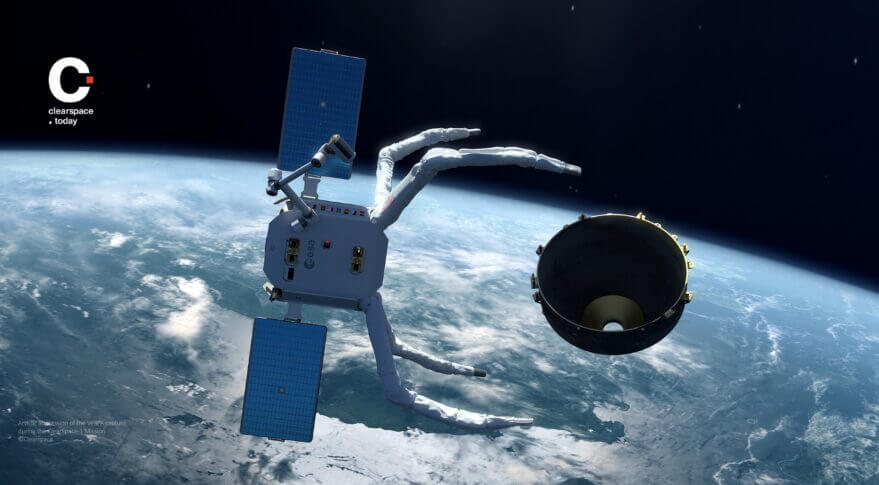

This mission will see the ClearSpace use a spacecraft with four articulated arms to de-orbit part of a Vega rocket from low Earth orbit (LEO).

“ClearSpace-1 is baselined to be launched on a Vega-C launcher,” Piguet told SpaceNews.

ClearSpace is on the UK Space Agency’s shortlist for a separate mission to remove two spacecraft from LEO in 2026. Japan-based in-orbit servicing startup Astroscale is the other contender for this contract.

In November, ClearSpace announced plans to extend the life of an Intelsat satellite before it runs out of fuel in geostationary orbit around 2026-2028.

Albeit not profitable yet, Durgnat said the startup “is already booking revenues from missions such as ClearSpace-1 and sponsorship.”

Swiss luxury watchmaker Omega is sponsoring ClearSpace-1.

Durgnat said ClearSpace expects to start booking commercial revenues sometime between 2026 and 2028.

ClearSpace, Astroscale, and others see growing demand for services that can reduce the debris that is threatening operations in increasingly congested near-Earth orbits.

There are 32,480 pieces of debris orbiting the Earth that are big enough to be tracked, according to ESA, and more than 130 million objects ranging in size from 1 millimeter that are currently untrackable.

Fundraising in a challenging economy

Financing has “become more tricky” in the current economic climate and deals are taking longer to close as increasingly risk-averse investors conduct more due diligence, noted David Ford, a partner at British financial services firm Silverpeak that advised ClearSpace on the funding round.

Valuations have also come down in the absence of “me-too capital that drove up valuations unrealistically before,” Ford told SpaceNews via email.

However, the “intelligent money” that remains comes from investors with more patience and understanding of how long it can take to get a return from companies in the space market.

These investors are reserving capital for follow-on fundraising activity, Ford added, “they expect that five years or so should give enough time for both the economy to get ‘back on track’ and also for significant revenues to start to flow, to prove the opportunity and business models.”

Lakestar, In-Q-Tel, Happiness Capital, and 600 T Space Investments also participated in ClearSpace’s Series A funding round.

Other space-related ventures that have successfully closed early-stage fundraising deals recently include NorthStar Earth and Space, Capella Space, and SpiderOak.