Charter, a CA-based space program management startup, has a plan to open up access to space insurance, the CEO told Payload.

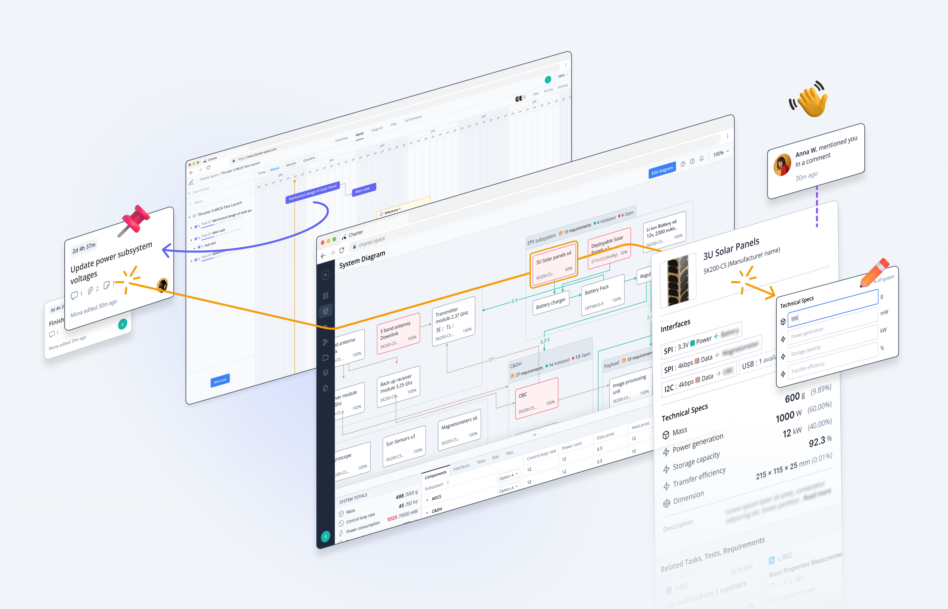

Charter’s Ubik operating system manages complex space programs, recording inputs and data during the manufacturing process of satellites and other spacecraft. By marrying that tech with an AI-powered underwriting tool, the startup is hoping to automate some of the burdensome process of creating insurance policies for space assets.

“[Underwriting] is a highly manual format, and because it’s so manual, essentially only a certain class of satellites—the very largest—can actually get insurance. It’s a problem of economics, because the actual underwriting process is so laborious and so time consuming,” Charter CEO Yuk Chi Chan told Payload.

The problem: Charter estimates that approximately 97% of the ~10,500 active satellites on orbit are uninsured. The bulk of those are smaller birds operating in LEO, where congestion can boost the risks of collisions.

This means that tens of billions of dollars worth of satellite technology is flying around without a financial safety net.

For insurers of space assets, this small risk pool has led to some devastating losses. In 2023—a year marked by the loss of the ViaSat-3 satellite, among others—Slingshot Aerospace estimated that space insurers paid out nearly $1B in claims, posting a net loss of $438M for the year.

“Some insurers are exiting the space industry, while the ones who remain are substantially increasing premiums to hedge against the record losses in the industry,” Slingshot’s general manager Melissa Quinn said in the report. Annual in-orbit insurance rates just about doubled in 2023, according to Slingshot.

Ultimately, this high barrier to entry means that many good ideas fail to get funding because financiers aren’t willing to take the risk on uninsured tech.

The solution: Charter is aiming for its insurance tool to increase the number of companies that can afford insurance.

“I hate using this term, but it will really democratize access to space because now all of a sudden, way more people can take risks without requiring a huge pool of capital behind them to basically buffer any shocks,” Chan said. “People want insurance, insurers want to insure, and there is basically a giant valley of death in between supply and demand.”

It takes a similar amount of time and effort to underwrite a small satellite as it does a large one, according to Chan, so automating part of this effort will vastly reduce the time and costs to craft a policy.

What’s next: When it’s up and running in 2025, Charter hopes its insurance tool will create a mutually beneficial insurance market.