Bryce Tech has released an in depth look at how small satellites have become an extremely big business over the past decade.

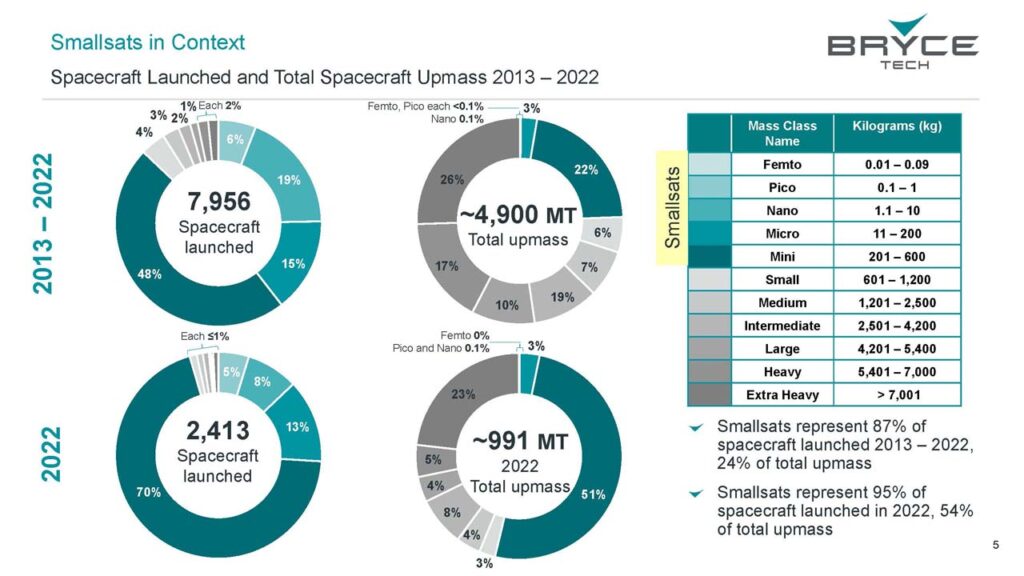

Small satellites represented 87% of all spacecraft launched over the past decade, and 95% of spacecraft launched in 2022. Smallsats have accounted for an increasing amount of upmass as operators have moved away from larger geosynchronous communications satellites.

Small satellites have allowed for the creation of large constellations providing communications, remote sensing and other services. Five companies owned 88% of the 5,675 commercial smallsats launched over 10 years.

U.S. operators owned 74% of the 6,893 smallsats launched from 2013-22. SpaceX’s Starlink satellites represented 51.8 percent of the total.

Despite multiple companies and governments spending billions of dollars to develop small and micro-satellite launch vehicles, they launch a small percentage of smallsats. There are three reasons for the low number.

The first is that smaller launcher vehicles don’t carry that many satellites, especially compared to rideshare missions like SpaceX’s Transporter flights that can launch more than 100 satellites at a time.

Second, many of these smaller launchers have only recently become operational, meaning they haven’t flown that often. These launch vehicles have also suffered a number of failures, which is not unusual for new boosters without much flight history.

The third reason is it would simply not be economical to launch many large satellite constellations on small boosters. SpaceX has launched as many as 60 Starlink satellites on dozens of Falcon 9 flights. The company orbited 3,570 Starlink spacecraft through 2022. OneWeb’s 542 satellites have been launched 34 to 40 at a time on Falcon 9, Soyuz-2 and GSLV rockets.

In addition to performing rideshare missions, medium and large launch vehicles also carry secondary payloads that are deployed along with larger satellites.

There are not that many small and micro-launch vehicles. Options are further constrained by export restrictions that limit access to China’s stable of smaller boosters.

You can download Bryce’s full report to learn more. Parabolic Arc has also written several stories looking at these topics:

Elon Musk Drinks Your Milkshake: The Impact of SpaceX Rideshare Missions on the Small Launch Market

Satellite Operators Face Limited Selection of Small Launch Vehicles as Sector Slowly Emerges